CargoON analyses trends in the European transport market in the first half of 2023

On the sidelines of the Supply Chain Event, which will take place on 14 and 15 November at Paris Porte de Versailles, the software solutions publisher for end-to-end transport management for CargoON chargers - a subsidiary of Freight Tech Trans.eu - publishes a 36-page study on transport market trends in Europe in the first half of 2023. Here are 6 key ideas to remember.

1. Diesel prices return to pre-war levels in Ukraine

At the end of April 2023, the average price of diesel returned to pre-war levels in Ukraine (February 2022). Many factors suggest that the fuel market will not be impacted by a new crisis situation in the coming months. This is because Europe has managed to build up sufficient oil reserves by importing from the United States (18%) as well as Norway, Kazakhstan and the Middle East. Significantly, however, the German economy was the most impacted by the Russian oil embargo. Diesel prices remained higher there until last fall due to its greater dependence.

2. Spot and contract rates continue to decline

Since the last quarter of 2022, there has been a steady decline in rates on spot and contract markets in the first half of 2023. European freight prices are falling more sharply in the spot market. Spot rates have fallen overall by 87% in the freight market. Prices per transport carried out on the spot market fell by an average of 7.5% and by almost 3% on the contract market. Consequence: some carriers are at the limit of profitability. This decline is mainly due to the economic slowdown of the old continent and still high inflation: 7% on average in the eurozone at the end of April 2023 according to Eurostat data.

3. Demand for transportation capacity is declining

The fall in the GDP of the European Union, the rise in inflation and the increase in energy costs have led to a fall in the demand for freight transport. In January 2023, transport rates were still 26% higher than in 2022 but, in the months that followed, they fell below last year’s level. Despite this decline, the challenges faced by carriers have not disappeared: high costs, a shortage of drivers and a rising wage trend, as well as other issues related to the operation and maintenance of vehicles. A global situation that benefits shippers who can thus achieve substantial savings on their transport budget.

4. Carrier charges continue to rise

Due to a relative drop in inflation, the costs of transport companies will increase on average from 12 to 13.5% in 2023 - with the exception of fuel costs - according to the calculation of the Belgian Institute of Road Transport and Logistics (ITLB). Higher costs force carriers to pass this increase on to shippers while taking into account the decline in demand.

5. Truck sales are up

The performance of truck sales in Europe is surprising given the economic slowdown observed. According to a report published by the German organization Verband der Automobilindustrie, 336,000 new trucks were sold on the continent in 2022 (EU and UK). This represents a 5% increase over the previous year. The current year also looks promising (data: ACEA). After the first quarter of 2023, the increase in sales of new trucks was 19.4%, or nearly 86,500 units in volume. Most of the new vehicles were purchased in Germany, France, Poland and Italy.

6. A trend towards electrification

Although the electric truck market is still a minority, there is an increase in orders in this segment. While 96.1% of the trucks purchased in the first quarter of 2023 were still diesel trucks, the number of electric vehicles registered during this period increased by 408.5%. They still represent a small share of the transport market (1.1% of all trucks in the EU), but everything indicates that in 2023 purchases of this type of vehicle will continue to increase.

“The relative stability of fuel prices and the slow decline in inflation rates are encouraging. The transport market, however, remains tight due to unfavourable growth forecasts that are impacting household consumption and, in turn, freight transport demand. While this economic environment is more favourable to shippers, it has a direct impact on carriers who have to face both a reduction in their margin and an increase in their expenses,” analyses Olivier Schulman, CargoON’s French Sales Director.

The full CargoON barometer is available at https://cargoon.eu/fr/

Dans la même catégorie

TRANS FOR FORWARDERS sets up in France

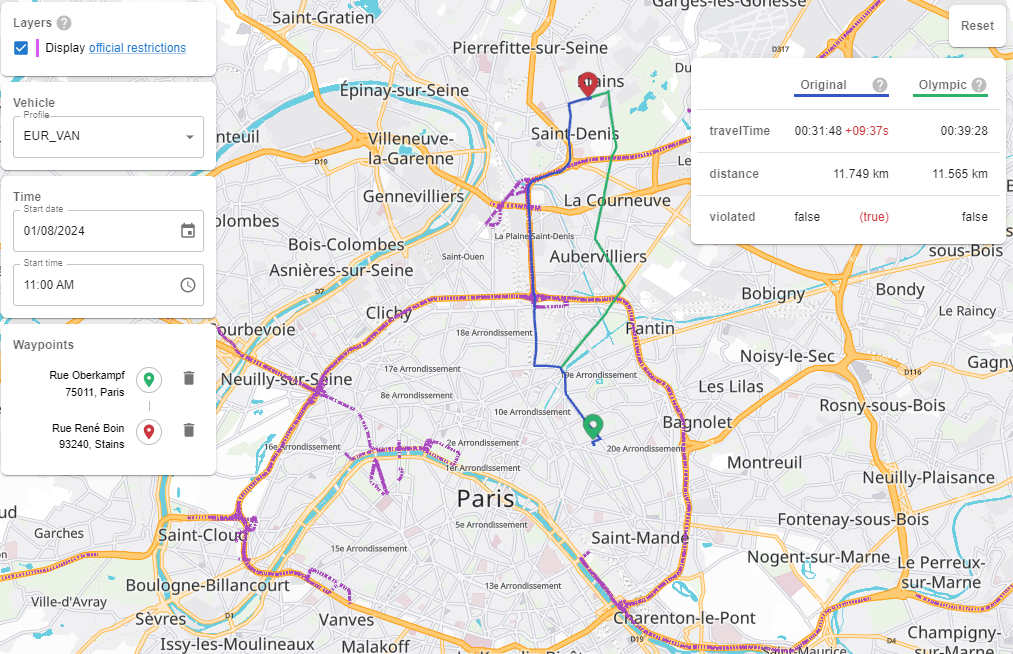

Olympic Games 2024: PTV Logistics publishes a demonstrator to help delivery companies anticipate traffic constraints in Ile-de-France